Why should I view the Transaction and Deposit Summary?

The Transaction and Deposit Summary is an easy-to-read feature that outlines what payments have been made and gives you a grand total with all of your transactions. Whether they were accepted, declined, returned, pending, voided, or refunded- it will calculate your totals to give you peace of mind of everything that has been processed in your office.

At the bottom of the Posted Payments Report Generator™, you will find your Transaction and Deposit Summary. The stats only reflect the payments that were entered in the date range of the search options. If you limit the report with the search options, the stats will be limited to the payments included.

Here are instructions for accessing your payments to include the Stats correlated.

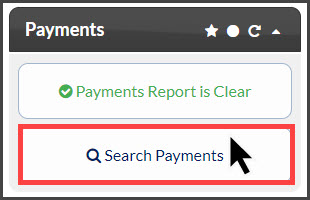

Step 1: From the Dashboard, click on the [Search Payments] button, located under the "Payments" section.

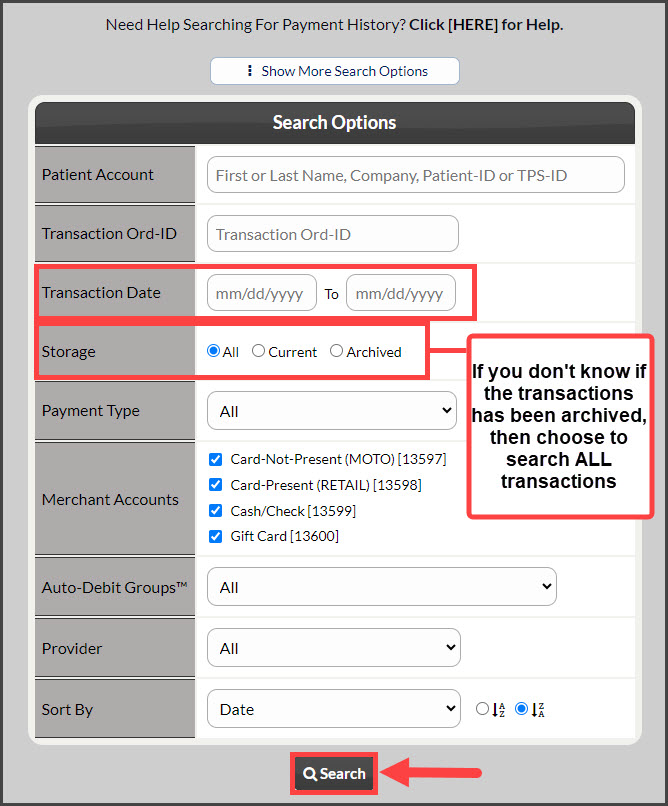

Step 2: Designate your Search Options and click [Search]. Remember to change your [Storage] to "All" if you are looking for payments that have also been Archived.

Step 3: Scroll down to the bottom of the page to review your transaction and deposit summary in detail.

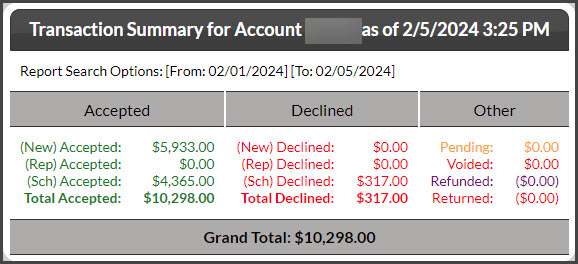

Let's first go over your Transaction Summary. Here's what it looks like:

This report is going to take all of your payments from your designated Search Options, and pull all Accepted, Declined, Returned, Refunded, Voided, and Pending Transactions to calculate a Grand Total.

For this example:

(New) Accepted are new one-time payments, that were accepted or declined.

(Rep) Accepted are re-processed payments that were accepted or payments that were re-processed that were declined.

(Sch) Accepted are payments that show accepted or declined scheduled Auto-Debit payments.

(GC) Accepted displays the redeemed amount for Gift Card collections.

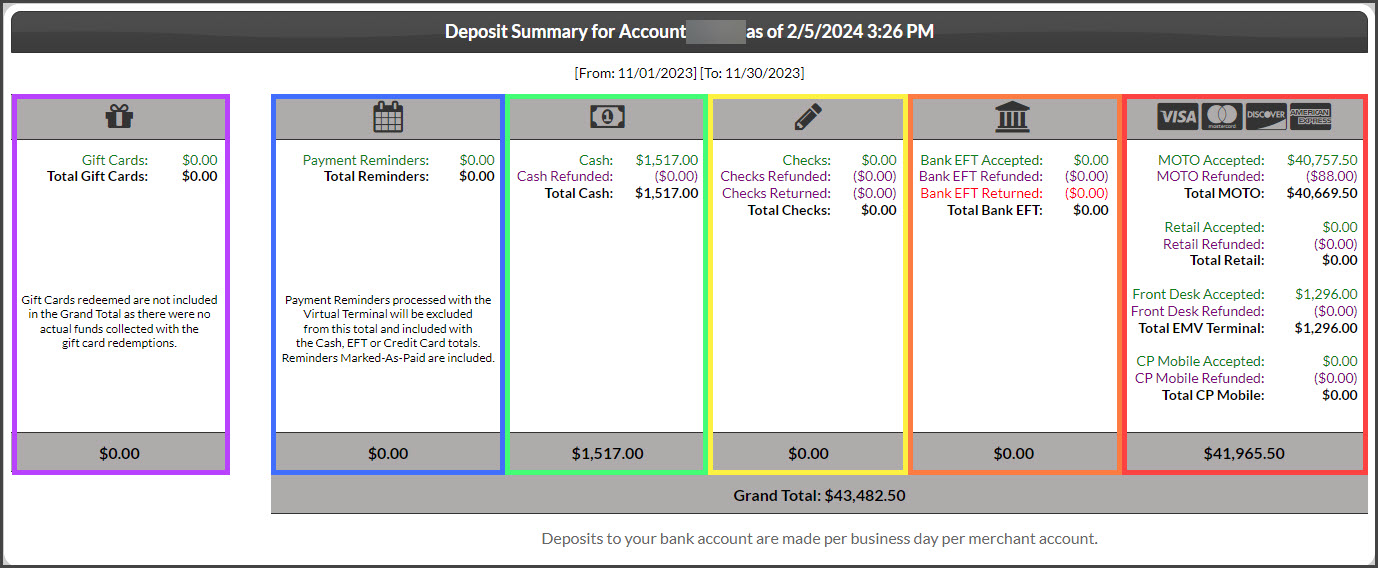

*This example shows the Grand Total the office collected for November 2023, which was $43,482.50

Next, let's go over your Deposit Summary. This is designed to show you a breakdown of which payments were made, and on which merchant account, to help you determine your deposits for this specific search criteria.

Here's what it looks like:

Keep in mind, that we have color-coordinated this image to help break down the columns for a clear explanation of what everything means here.

Purple: Shows the redeemed Gift Card collections

Blue: Payment Reminders will show all collections recorded for payment reminders.

Green: Cash collections recorded through the Virtual Terminal

Yellow: Check collected recorded through the Virtual Terminal or if a patient chooses to pay by check for the first month of their care plan

Orange: Bank EFT payments that were accepted, refunded and returned. Then, if you accepted, refunded, and returned, it will give you a total for that section.

Red: Visa, MasterCard, Discover, and American Express Credit Card payments are processed on your Moto Merchant Account and Retail Merchant Account. Payments processed on your Moto Merchant Account are payments that are been Key-Entered and Auto-Debit payments. Payments made on your Retail merchant account are swiped transactions. This column will reflect all of your Moto CC payments that have been accepted, and refunded, as well as a breakdown of your Retail payments that have been accepted or refunded. Also listed here is a breakdown of collections from your EMV terminal(s) and any transactions processed through the CP Mobile™ app. You will then get a total of your payments combined.

You will then receive a Grand Total with all of your payment columns combined for Reminders, Cash, Bank EFT's, Visa, MasterCard, Discover, and American Express Payments on both Moto and Retail Merchant Accounts, EMV, and CP Mobile™.

See related articles to learn about the different types of merchant accounts.