What is the benefit of the Insurance Visit Estimator™?

The Insurance Visit Estimator™ is a convenient tool for accurately estimating insurance benefits for a treatment plan. It is particularly useful when insurance companies provide only the dollar amount of coverage (e.g. $1,000 at 80%) without specifying the number of visits covered. This tool helps calculate insurance benefits and determine the patient's out-of-pocket expenses, ensuring that care remains affordable and easy to understand. Follow these instructions to access and make use of the Insurance Visit Estimator™.

To get started, follow the sequence below.

- A: Hover over [Systems]

- B: Click [Care Plan Calculator®]

- C: Select [Insurance Visit Estimator]

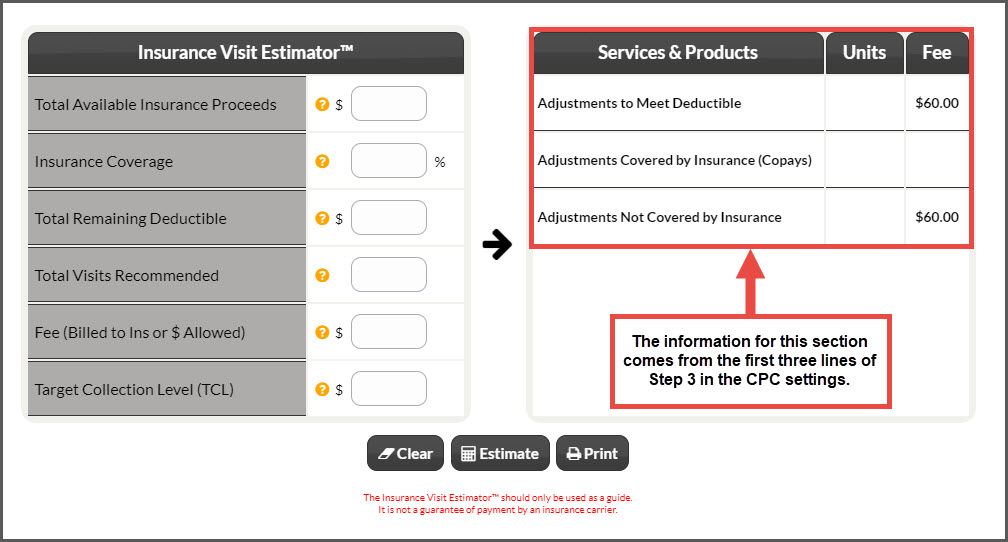

Step 1: Enter the required fields for this tool.

- Total Available Insurance Proceeds: This is where you will note the total expected insurance proceeds. If the insurance company has an unlimited amount of coverage, enter a large amount such as $10,000.

- Insurance Coverage: Enter the percentage that the insurance company will cover.

- Total Remaining Deductible: Enter the total remaining deductible for the treatment plan.

- Total Visits Recommended: for the course of the treatment plan.

- Fee (Billed to Ins or $ Allowed): Enter your Usual and Customary Fee for an adjustment. If you know the fee is limited to an "Allowed Amount" because of PPO/HMO participation or other arbitrary limits, enter that fee here instead.

- Enter your Target Collection Level (TCL): For instructions on how you can obtain your TCL, please follow the instructions found HERE.

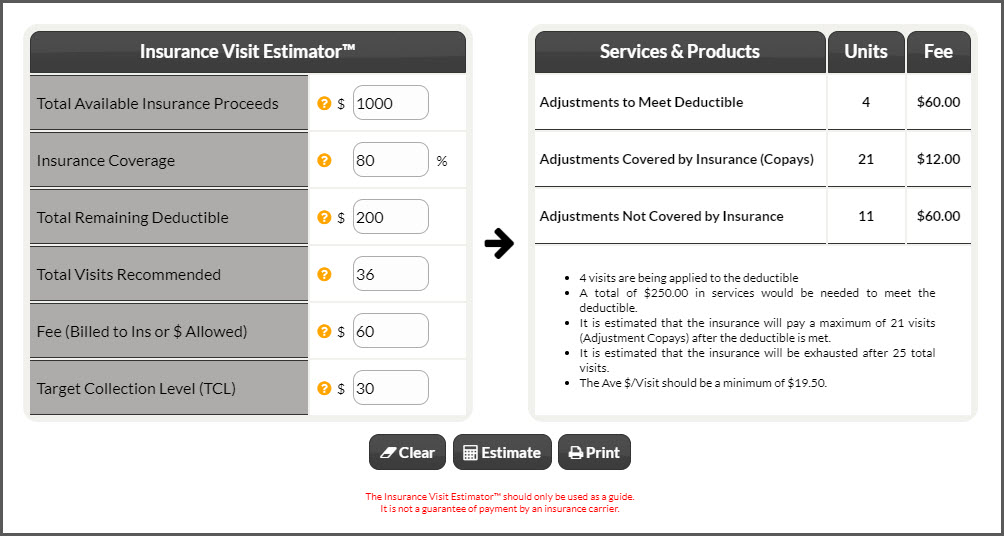

Step 2: Click [Estimate]. The system will calculate the first three lines of information needed for this particular Care Plan! Check out the example below:

- Total Available Insurance Proceeds: For this example, $1,000.

- Insurance Coverage: For this example is 80%

- Total Remaining Deductible: For this example, the remaining deductible is $200.00

- Total Visits Recommended: For the course of the treatment plan. In this example, there are 36.

- Fee (Billed to Ins or $ Allowed): Enter your Usual and Customary Fee for an adjustment. If you know the fee is limited to an "Allowed Amount" because of PPO/HMO participation or other arbitrary limits, enter that fee here instead. The fee for this example is $60.00

- Enter your Target Collection Level (TCL): In this example, the TCL is $30.

The Adjustments to Meet Deductible, Adjustments Covered by Insurance (Copays), and the Adjustments Not Covered by Insurance will go on the first three lines of the Care Plan that you're creating. For instructions on how to edit a Care Plan, please go HERE.