Target Collection Calculator™

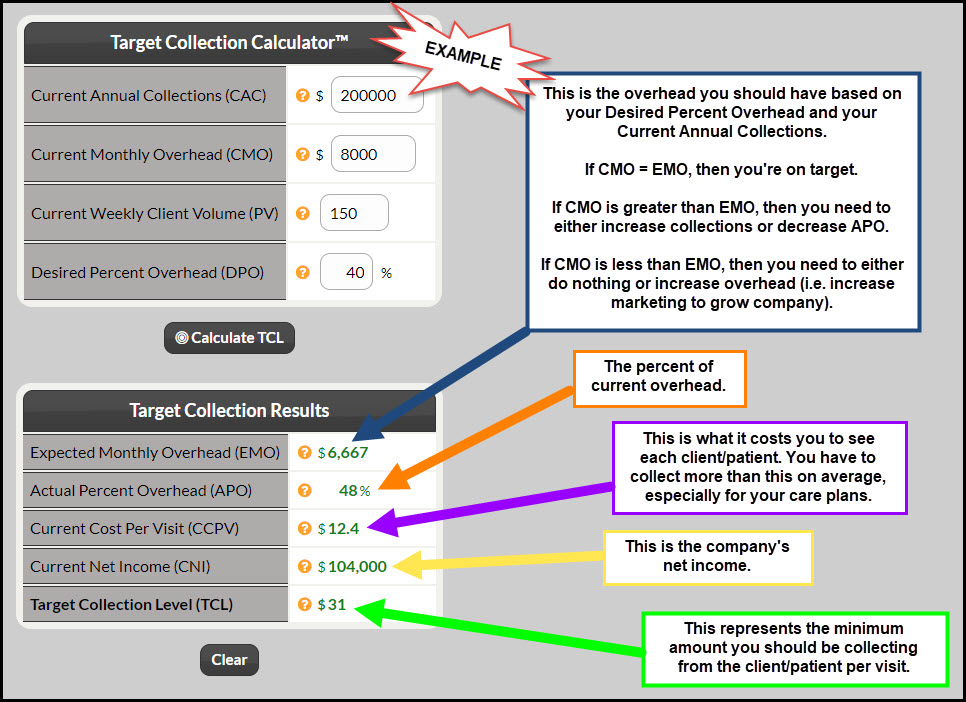

The TCL is used as the MINIMUM benchmark for the Ave Cost Per Visit (i.e. Ave $/Visit) when creating a care plan. It's important to understand that the TCL only accounts for the PATIENT PORTION and does not include any insurance proceeds.

Therefore, your TCL will not equal the practice's Gross Ave $/visit (Gross Ave $/Visit aka GAPV). The GAPV is simply your gross collections (patient & insurance proceeds) for a given period of time divided by total office visits for the same period of time. For example: $400,000 Annual Gross Collection / 7272 Annual Visits = $55 GAPV). However, you may have a TCL of only $35 (which only accounts for the patient portion).

In summary, don't expect your TCL to be equal to your GAPV. And don't expect the Ave $/Visit for your plans to be equal to your GAPV.

Note: You must be signed in as the administrator on the account or have permission to access this portion of the site.

For more information on what the Target Collection Level (TCL) is, click HERE.

The Target Collection Level™ is determined by a simple formula based on your Practice Overhead, Patient Volume & Desired Percent Overhead.

Getting Started:

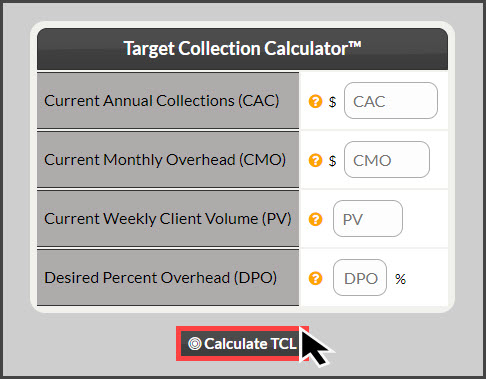

Step 1: Follow the sequence below.

- A: Hover over the [Systems] menu

- B: [Care Plan Calculator® System]

- C: [Target Collection Calc™]

Step 2: Enter in [Current Annual Collections (CAC)]. This includes all proceeds. We recommend using the last 12 months.

Step 3: Enter [Current Monthly Overhead (CMO)]. This does not include any of the doctor/owner's salary or any personal items (ex: car lease). This should only include the hard costs of operating your company (i.e. payroll, rent, insurance, utilities, supplies, etc.).

Step 4: Enter in [Current Weekly Patient Volume (PV)]. This is the total number of visits you typically see per week.

Step 5: Enter [Desired Percent Overhead (DPO)]. Typically 35%-55% is good. We recommend 40% for a cash-based practice.

Step 6: Click [Calculate TCL].

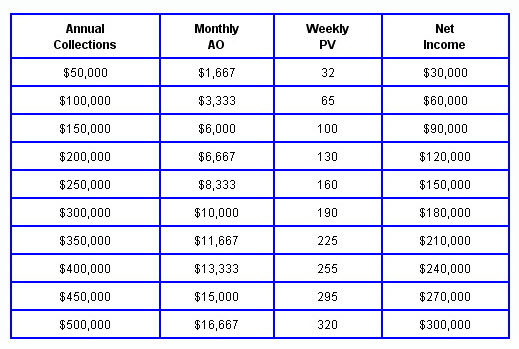

Below is a chart showing the stats of different practice levels in Practice Equilibrium (PE) with a Desired Percent Overhead (DPO) of 40% and a Target Collection Level of $ +/- $1. The Annual Collections and Net Income are MINIMUM Benchmarks for each Weekly PV.

Overhead really high?

Here are some of the best ways to reduce overhead:

- If you accept insurance in your practice, use an outside billing company to stay on top of insurance claims and reimbursements. Paying an outside company a percentage of the claims is much less expensive than the payroll expense of a staff member.

- Typically the most expensive part of the practice is payroll, therefore you should analyze your payroll and make a determination if it's too high. Payroll should be limited to 15-30% of gross. The more cash you are, the closer to the 15% it should be.

- Review your Profit and Loss Statement and analyze where you're spending money, then identify everything that you do not need.