Simplifying Plans With Insurance

Care plans are the foundation of patient retention, which is why it's important for patients to be on a care plan right from the start of care. This session demonstrates how to build care plans that incorporate insurance benefits. We will show you how to factor in the deductible, copays, and coinsurance. In addition, we walk through how to communicate the financial conversation with the patient.

Remember that the information you plug into the Care Plan Calculator® System does not get entered into your patient management software. The care plan simply generates your recommendations for care, the time frame of care, and the patient's financial responsibilities to your office. If a discount is given on the non-insured services/ products, you will adjust the patient's ledger by posting a 'write-off.'

When creating a plan with insurance, there will be some work on your part in the beginning; however, you will be rewarded for your efforts.

You (or your staff) will need to call and verify the insurance benefits (contracted or not) and make a care plan "Template" for that insurance company.

With that information, you will create dozens of templates using the Care Plan Calculator® System [CPC]. When a patient comes in with that insurance, you simply access the appropriate template from the CPC and make a [Copy] of it, customizing it for the patient by quickly adding the patient's name and saving it. (See example below)

Example:

- 12 Month 80 Visit Corrective Care Plan Aetna

- 12 Month 80 Visit Corrective Care Plan BCBS

- 6 Month 40 Visit Corrective Care Plan United Healthcare

- 6 Month 40 Visit Corrective Care Plan Aetna

- 6 Month 40 Visit Corrective Care Plan BCBS

- 6 Month 40 Visit Corrective Care Plan United Healthcare

- John Doe 6 Month 40 Visit Corrective Care Plan BCBS

- Bob Smith 12 Month 80 Visit Corrective Care Plan

And so on…

When creating plans using the Care Plan Calculator® System (with any type of insurance) ask yourself the following questions:

- Is there a remaining deductible?

- How many visits will it take to meet the deductible?

- How many visits are covered by insurance?

- What's the patient's co-pay?

- How many months or weeks will the care be provided?

- How many visits are being recommended to the patient for this care plan?

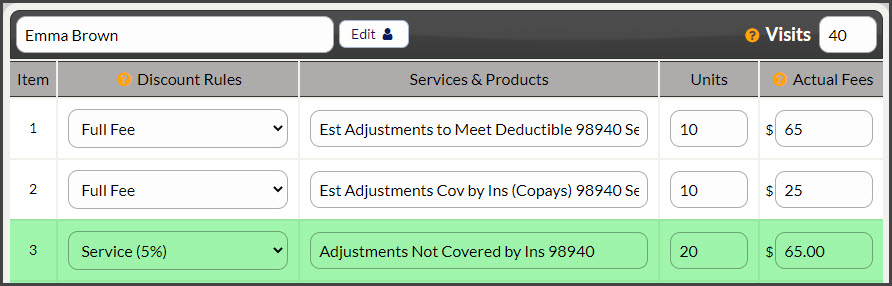

When you have the answers to those questions, you can begin creating the plan using the following example: (Add New Care Plan > Enter information into the Care Plan step)

Step 1: Visits Needed to Meet Deductible [units] at [fee] (Full Fee) *If you are an In-Network Provider refer to your contracted rates for the allowed amount*

Step 2: Visits Covered by Insurance (Co-Pay) / (CoIns) [units] at [fee] (Full Fee)

Step 3: Visits Not Covered by Insurance [units] at [fee] (Discounts can only be applied on non-insured visits. *If you are an In-Network Provider, refer to your contract for handling non-insured services.)

In this example:

- The patient has 10 visits to meet their deductible at $65 each. [Full Price]

- After the deductible is met, the patient has 10 visits covered by insurance, with a co-pay of $25 each. [Full Price], and there are 20 visits that are not covered by insurance at $65.

- Only the non-covered services can be discounted. [Optional: Discounted]

Scripting to explain the plan to the patient:

"Based upon your estimated insurance benefits, we have outlined the following...

If your insurance pays any differently, we will re-calculate the plan and let you know right away if there is a difference."

When you receive the EOBs the insurance does, in fact, pay differently. Per the "Terms of Agreement" (page 3 of the plan), you will make a new plan as if on day one you had the EOB. Then present the new plan and adjust any auto-debits, collect the difference or apply the credit.

Additional information regarding posting insured visits the ledger:

An office will not change the fees for services (a big no-no). If an adjustment is $65, then when the service is posted, it will post to the ledger at $65. Even if the patient is on a care plan and prepaid.

- The service is posted to the ledger accurately.

- A write-off is applied to adjust the balance due to the visit per the financial agreement for non-insured visits. (Most offices adjust the balance manually once per month OR their Patient Management Software adjusts the balance for them automatically.)

The insurance company will not reimburse the patient more than they have paid to the provider, as the receipts and ledger would reflect that.